Is Asian Paints Stock A Good Investment – Asian Paints is India’s leading paint manufacturer with a dominant market share of over 50% in the decorative paint segment. The company sells a wide range of interior and exterior paints, coatings and ancillary products under trusted brands like Asian Paints, Berger and Apcolite. With its strong brand, distribution reach, product portfolio and financial performance, Asian Paints has emerged as a good long term investment. However, let’s analyze in detail if the stock remains a good buy at current levels.

Leadership Position

- Asian Paints is the undisputed market leader in India’s paint industry with a market share of over 50%.

- It sells one out of every two paint buckets sold in India.

- The company sells its products through a network of 5000+ dealers across the country.

- It has one of the strongest brand equities in India with high recall and reputation for quality.

- The leadership position presents strong entry barriers for newer players.

Asian Paints competitive advantages make it well positioned to tap into the huge growth potential of India’s underpenetrated paint market.

Strong Financial Performance

- Asian Paints has delivered strong and consistent revenue and profit growth over the past decade.

- Revenues have grown at a CAGR of 11% over FY12-22 to Rs. 21,712 crores driven by volume growth and pricing power.

- Operating profits have risen at 15% CAGR during this period to Rs. 4,056 crores.

- Operating margins have improved from 15% to 19% led by cost rationalization initiatives.

- Return on capital employed has averaged an impressive 35% over the past 10 years.

The robust growth in sales and profits demonstrates the company’s strong business fundamentals.

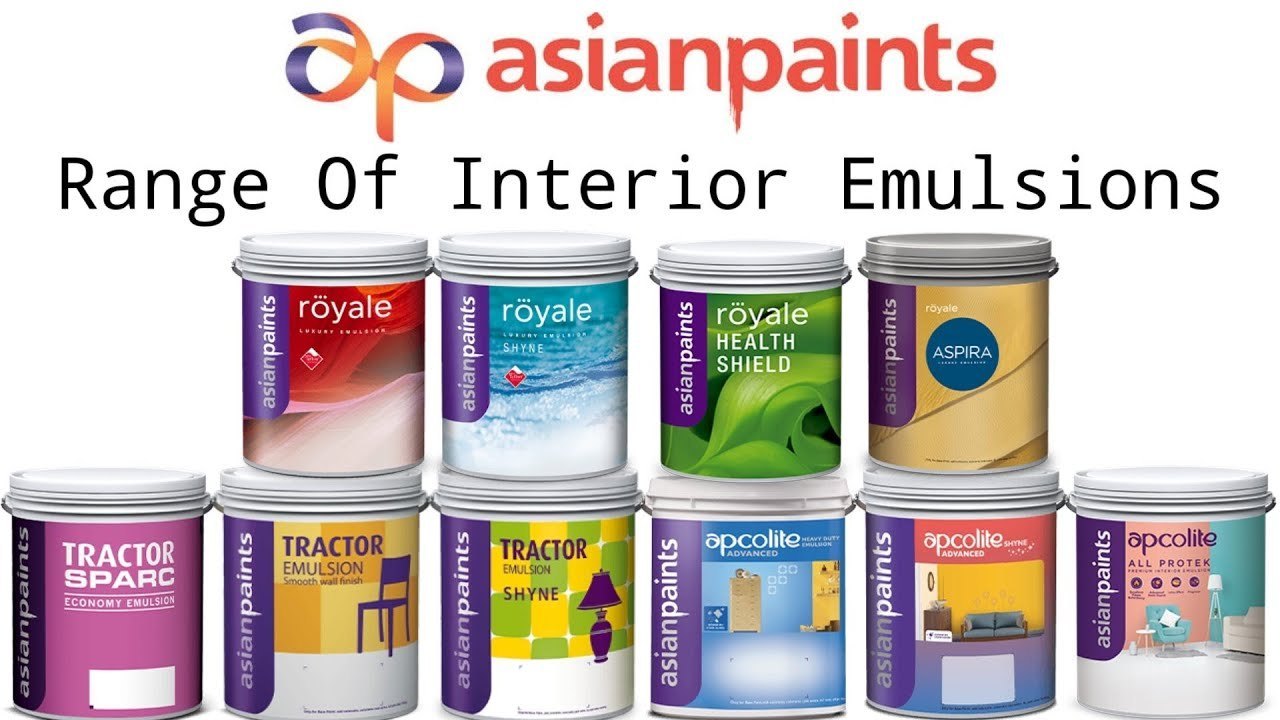

Diversified Product Portfolio

Asian Paints has built a diversified product portfolio to cater to varied customer needs:

- Decorative paints including emulsions, distempers, primers, wood coatings etc.

- Industrial coatings – automotive, protective and powder coatings.

- Home improvement products like kitchen and bathroom fittings.

- Decor solutions comprising textures, designer laminates etc.

The diversified product range provides revenue stability and insulation against demand cycles in any particular segment.

Strong Distribution Network

- Asian Paints sells its paints through 5000+ dealers across urban, semi-urban and rural markets.

- It reaches out to over 300,000 retail outlets to ensure easy product availability.

- The company offers strong sales and marketing support to its dealers.

- It has bolstered its distribution further through innovative idea centres.

The widespread distribution gives Asian Paints a significant competitive edge especially in tapping rural demand.

Focus on Innovation

Asian Paints continuously invests in innovation through its R&D facilities across India, Singapore and United States.

- It has launched advanced products like temperature regulating paints, moisture resistant coatings, bacteria resistant paints etc.

- The company introduced services like colour consultancy and colour visualization to aid customers.

- It is also making inroads into new adjacent categories like kitchen fittings, flooring solutions etc.

The focus on innovation helps Asian Paints differentiate itself and stay ahead of competition.

Strong Financial Position

- Asian Paints has a debt free balance sheet with surplus cash reserves of over Rs. 1,700 crores as of Mar 2022.

- It has a very high credit rating indicating robust finances.

- The company is highly efficient in managing working capital with negative operating cycle.

- Good cash generation funds its growth expansion and dividend payouts.

The fortress like balance sheet provides huge financial flexibility for Asian Paints to tap growth opportunities.

Valuation Seems Stretched

- Asian Paints stock trades at a PE multiple of around 95x its trailing twelve month earnings.

- The valuations seem extremely stretched even when compared to its own historical multiples and growth rates.

- There is risk of de-rating if growth moderates or competition intensifies.

- Investors may be better off waiting for more reasonable valuations.

Sizeable Dependence on Decorative Segment

Despite expanding its products portfolio, Asian Paints still derives 80% of its revenues from decorative paints segment.

While the outlook on this segment remains positive led by lower per capita consumption, any slowdown in real estate sector can impact growth. Diversifying further into industrial and other segments is key from a risk perspective.

Overall, Asian Paints remains one of India’s best consumer franchises given its leadership status, strong brand equity, distribution reach and sound financials. The company is well positioned to tap into huge growth opportunities with gradual shift towards organized players, rising incomes, urbanization and more housing demand. However, valuations appear very expensive currently. Investors may consider accumulating the stock in phases on significant corrections for the long run.

Is Asian Paints Stock A Good Investment? – FAQs

What is Asian Paints’ market share in the paint industry?

Asian Paints has a market share of over 50% in the Indian decorative paint market making it the dominant player in the industry.

What is the percentage of institutional holding in Asian Paints?

Over 35% of Asian Paints shares are held by institutional investors including mutual funds, insurance companies, FIIs etc. indicating strong institutional backing.

How has Asian Paints stock performed in last 1 year?

Asian Paints share price has declined around 13% in last 1 year underperforming the broader indices due to expensive valuations.

What are the risks or challenges for Asian Paints?

Key risks are slowdown in housing sector, competition from new entrants like Grasim, volatility in raw material costs, high valuations and over-dependence on domestic decorative paint segment.

How does Asian Paints compare with peers like Berger Paints?

Asian Paints is much larger than Berger Paints with over 3X market share and revenues. It scores higher on metrics like profitability, distribution reach, brand strength and working capital management. Valuations are also higher.

Does Asian Paints pay dividend? What has the trend been?

Yes, Asian Paints has consistently paid dividend since 1993 and grown DPS at 20% CAGR over the past decade. The current dividend yield is around 1%.

What is the outlook on paint industry growth in India?

The Indian paint industry is expected to grow at a healthy CAGR of 15-18% over the next 5 years driven by increased demand from housing sector and growth of organized players.

Is Asian Paints stock expensive at current levels?

Yes, Asian Paints stock appears very expensive at around 95x trailing P/E. Investors may wait for significant correction to build a position from a 2-3 year perspective.

Conclusion

In summary, Asian Paints has several compelling strengths – market leadership, strong brand equity, widespread distribution, innovation focus and financial might. The company is well positioned to tap into the underpenetrated and fast growing Indian paint market. However, current valuations seem overly optimistic and leave very little margin of safety. Investors would do well to wait patiently for reasonable entry opportunities closer to 60x P/E to make Asian Paints a part of their core long term portfolio.

For Latest review on best stocks and ipo follow on YouTube, Facebook and Instagram.