Is Maruti Stock A Good Investment – Maruti Suzuki India Ltd (NSE: MARUTI) is India’s largest passenger vehicle manufacturer commanding over 40% market share. Backed by parent Suzuki Motor Corporation of Japan, Maruti enjoys a strong competitive position in the high growth Indian auto market. But after a prolonged underperformance, does Maruti stock offer a good investment opportunity for long term investors? Let’s analyze in detail.

Overview of Maruti Suzuki India

Here are some key facts about Maruti’s business profile:

- Incorporated in 1981, commenced production in 1983

- Flagship company of Suzuki Motor Corporation with 56% stake

- Market leader in passenger vehicles with 40%+ market share

- Major manufacturing facilities located in Haryana and Gujarat

- Extensive sales and service network of 3,600+ outlets across India

- Product portfolio includes entry level cars, compact sedans, SUVs, vans and light commercial vehicles

Maruti enjoys a strong competitive position in India’s high growth, cost-sensitive car market. It dominates segments like compact hatchbacks, entry level sedans and vans. But outlook remains challenging.

Detailed Analysis of Maruti’s Recent Financial Performance

Let us analyze some key financial metrics to gauge Maruti’s current performance:

- Revenues declined from Rs 83,000 crores in FY19 to Rs 71,000 crores in FY22 due to pandemic impact

- Net Profit fell from Rs 7,500 crores in FY19 to Rs 4,400 crores in FY22 for the same reason

- Operating Margins contracted from 15% levels to around 10% in FY22 on account of higher costs

- Return on Equity declined from 28% in FY18 to 15% in FY22 due to weak earnings

- Debt to Equity ratio continues to remain negligible at 0.01x highlighting strong balance sheet

- Key volume drivers were models like Alto, Swift, Baleno, Ertiga, Vitara Brezza

- Launched SUV models like Grand Vitara and Brezza Petrol to tap into faster growing segments

While the financial performance weakened in the last 3 years, Maruti remains strongly placed to tap recovery in demand. Profitability is also showing signs of revival this fiscal.

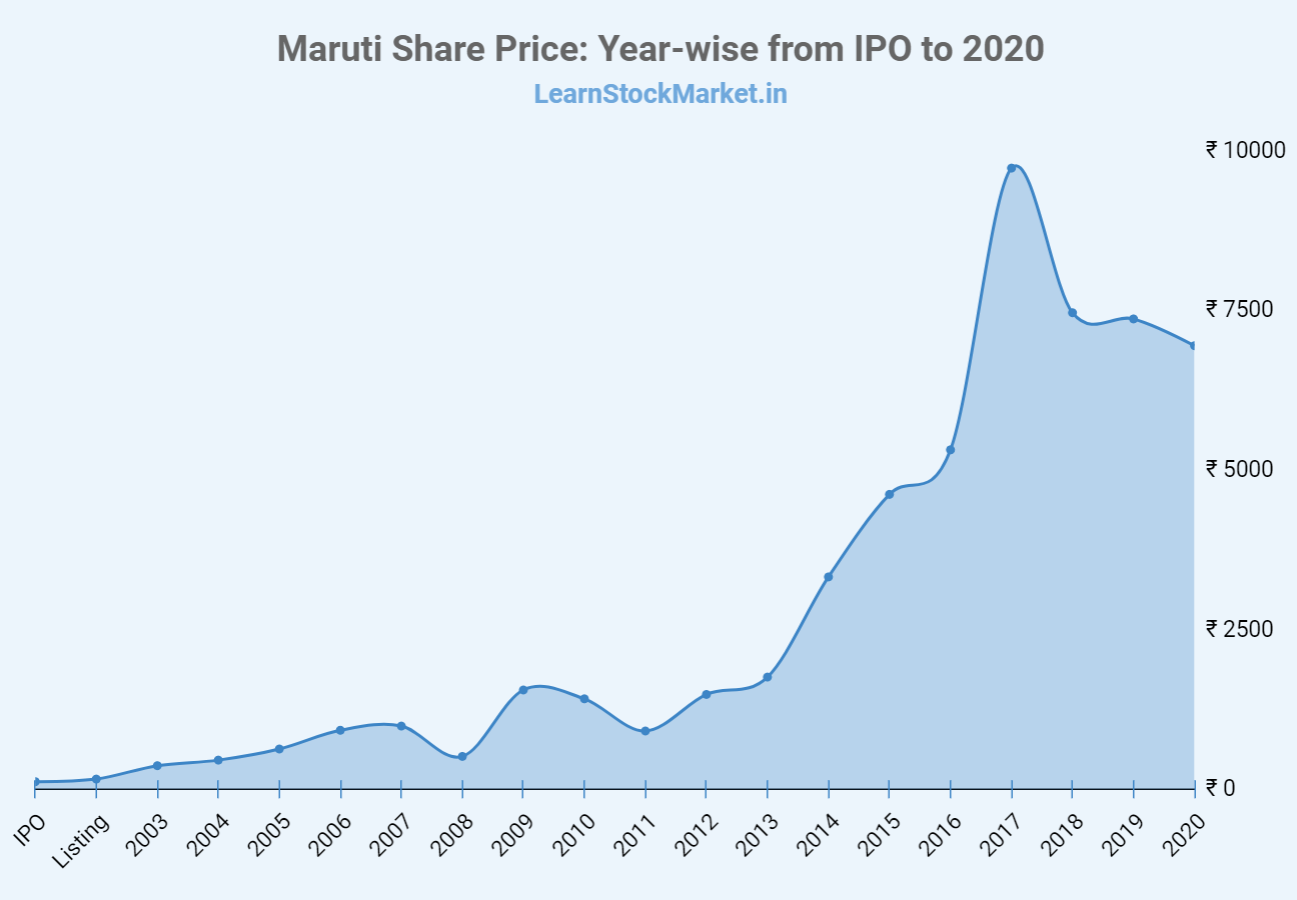

Maruti Suzuki Share Price and Valuation Breakdown

- Maruti share price has been largely rangebound in the past 5 years trading between Rs 5,500-8,500

- Currently trades at Rs 8,750 as on Nov 2022 compared to Rs 7,200 in Nov 2021 – up over 20% in 1 year

- Market Capitalization stands at Rs 2.7 lac crores currently

- Stock trading at P/E ratio of 44x based on FY23 annualized earnings indicating expensive valuations

- Price to Book value of 4.7x also appears high historically

Thus, Maruti stock valuation seems stretched currently limiting the margin of safety for investors at current market price.

Growth Outlook and Key Risks

Maruti has multiple drivers that can fuel double-digit earnings growth over next 5 years:

- Huge underlying demand for passenger vehicles as ownership increases

- New model launches planned in fast growing SUV segment

- Increased localization and cost reduction efforts to aid margins

- Investment in new technologies like electric vehicles, autonomous cars

- Strong parentage of Suzuki and existing competitive advantages

However, some key risks to consider:

- Competitive intensity remains high with new players entering Indian market

- Margin pressure from regulatory costs like safety norms, rising commodity prices

- Delay in recovery in rural automobile demand due to macro factors

- Chip shortages affecting production and long waiting periods

- Adverse currency fluctuations and dependence on imports

Overall, long term growth outlook remains positive for Maruti but near term headwinds persist.

The Final Verdict: Should You Buy Maruti Shares?

Let us summarize the analysis on Maruti Suzuki:

Positives – Dominant player in cost-sensitive car market, strong brand equity, extensive distribution reach, financial strength of parent Suzuki and reasonable growth outlook.

Negatives – Premium valuations leave limited margin of safety, competitive intensity remains high, margin pressure from regulations and input costs.

Maruti remains a key stock to play India’s passenger vehicle growth story. The recent underperformance offers chance to accumulate for long term. Investors can buy Maruti stock in staggered manner on 10-15% declines. Hold with 3-5 year perspective as near term volatility is likely to persist.

Frequently Asked Questions on Maruti Stock

Should I buy Maruti Suzuki shares at current levels?

Maruti stock valuation at 44x FY23 P/E appears stretched currently. Investors are better off waiting for 10-15% price corrections to buy this stock rather than chasing prices at current levels. Maruti remains a good investment bet for long term but entry point matters.

What is the outlook for Maruti share price for 2023?

Most analysts expect Maruti share price to trade rangebound between Rs 8,000-9,500 levels over next 12 months. This points to limited upside from current share price of Rs 8,750. Stock may remain volatile given premium valuation and challenging macro environment.

Does Maruti Suzuki have multibagger return potential in 5 years?

Yes, Maruti stock price can potentially double over next 5 years driven by recovery in volumes and profitability. But strong earnings growth and sustenance of premium valuations are crucial for multibagger returns which appears challenging currently given the near term headwinds and competitive intensity.

What is Maruti’s target price in 2-3 years? Is it a good buy for long term?

Maruti share price target over a 2-3 year period could be around Rs 12,000-13,000 if earnings grow at 12-15% CAGR. However, the journey to this level may not be linear given the premium valuations. Long term investors can accumulate the stock on declines from an investment horizon of 3-5 years.

Should I continue holding Maruti if I have a long term view?

Investors who already own Maruti stock can continue holding their positions from a long term perspective. The recent underperformance offers chance to accumulate more on declines to bring down average purchase cost. Maruti remains a core auto sector stock for long term portfolios despite near term challenges.

How does Maruti Suzuki compare with Tata Motors for long term investment?

Maruti scores better in terms of dominant market position, lean balance sheet, better profitability track record and parentage support. However, Tata Motors has better valuation comfort and turnaround potential. Investors can look to have a mix of both stocks in their portfolio for balancing risk-reward.

What are the key downside risks for Maruti amid the push for green mobility?

Key downside risks are potential disruption from faster electric vehicle adoption, missing out on SUV segment growth, chip shortages extending long waiting periods and loss of market share to competitive OEMs. However, Maruti’s strong hold in entry segments and investments in new technologies provide cushion against these risks.

Is Maruti Suzuki stock worth investing Rs 1 lakh today for 5 year horizon?

Maruti stock can potentially deliver 15-20% CAGR returns over next 5 years making it a decent bet for Rs 1 lakh investment today for long term investors. However, expectations need to be moderated given the premium valuations and near term headwinds. Investors should stagger their investment through systematic accumulation rather than lump sum allocation.

Which is better among Maruti and M&M for 5 year investment?

Maruti edges past M&M currently on metrics like market leadership, stable margins and balance sheet strength. However, M&M scores better in terms of valuation comfort and growth outlook in rural and SUV segments. Investors should ideally split their allocation between these two auto majors to benefit from exposure to both.

For Latest review on best stocks and ipo follow on YouTube, Facebook and Instagram.